Max released his small hands from yours and dashed towards his favourite LEGO shop. You let out a heavy sigh and a voice whispered in your head, “Oh no, here we go again.” It has been a rough week for you dealing with tight deadlines at work and then, having to spend on unexpected home repairs. Both you and your husband have already been struggling with finances and finding ways to cut down expenses. And now, your child begs you to buy him a new LEGO toy when he has other toys at home. “Your parents don’t have the money to buy for you. Come, let’s go.” As usual, you try explaining but your child just drops to the floor wailing, crying and begging you to buy it for him. The more you refuse, the louder he screams.

Now, think about it, many parents would say it is normal for kids to behave like that because they are young and do not understand the value of money. Question is, why do we want them to learn swimming or ballet, but not money skills? Because money related topics should be discussed among adults? Or perhaps we, as parents are not good with money as well. Most of us are only financially literate when we entered the workforce and we only learn from trial and error. However, financial literacy is an important life skills and it is extremely important to have them learn to establish good money habits at an early age.

Starting Early

A 2013 study by Cambridge University has shown that children are ready to learn about financial literacy from 5 to 7 years old. At this age, they’ll eventually notice and learn their parents’ spending habit. Parents play a pivotal role in educating your child in financial literacy and as well as being a good role model to them. You have to set a healthy example for them and they’ll be much more likely to follow when they are older.

Like why we always emphasize on the importance of early childhood education, children’s critical thinking and decision making is largely influence by their ‘habits of mind’. Planting the seed of financial literacy in your child’s mind early eventually helps them to build a strong foundation for their future. Your children will not only learn about money, but also responsibility, family values and attitudes, decision-making, comparative shopping, and setting goals and priorities.

Money Concepts

Parents can always start off teaching your children with the basic money concepts:.

- Concept of Earning – How money is earned? What do adults have to do to earn money? Why do we need to earn money? Is it easy to earn money? Let your child understand the hard work that goes behind earning money, so they have to treasure money and not spend as they like. You can also share with them about your career and why you chose it.

- Concept of Saving – Why is saving important? Why must you set aside money for future use? What is the benefit of setting an emergency fund? Parents can start giving your kids allowance as soon as they can count money. While children tend to save for a short term goal to buy a new toy, it is important to teach them the importance of long term saving as well.

- Concept of Spending – As kids are generally impulsive buyer as they using your money. Therefore, parents play the most important role to not give in so easily. Teach your child about being responsible with handling or managing their money. For example, spending on necessary things such as bills and food. What are the differences between wants and needs? What is budgeting and spending within your means?

- Concept of Sharing – Once they have saved up some money, be sure to teach them about sharing and that giving back is an important part of life. They can start by donating their old toys to the charity, and it is even better for parents to bring them to visit any of the orphanage or old folks home. Let them understand the importance of reaching out to others in their time of need.

Hands-On Experience and Games

In this world that is rapidly advancing, children now learn better through games, activity and hands-on experience. While schools are adopting holistic education, we as parents should also find fun and creative ways to incorporate money lessons into our children’s daily life. Children learn best through daily application and entrusting them with responsibility to manage money. Here are some simple activities and games you can do everyday with your child that you can enrich them with money lessons:

- Shopping

You can turn grocery shopping and mall outings into a fun teaching experience for your children. Instead of just looking at the items, show your child the different prices of the same item and have them compare the different values. Entrust your little one to pay for your shopping and count the change to let them experience what it’s like to use money to exchange for things. As they gets older, you can show them the difference between wants and needs such as not needing to buy more pencils when they already have 3, but instead spend the money on an eraser because their old one worn out. To spice things up, whenever you’re having a party or a beach outing, give them a task to list down what they need, give them a budget and let them plan out their own shopping list! This teaches them the value of money, self-discipline and budgeting.

- Let them have their own piggy bank or savings jar

As traditional as it can be, savings jar and piggy bank are still wonderful teaching tools to show children how money can grow. Most children love collecting things like toys, stickers and more. So, why not turn saving money into a collection game? Give them some coins or allowance each day and let them deposit it into their jar or piggy bank. At the end of the month, get them to empty out the jar and count the money. You can take them out to buy something small with the money.

- How does a Bank Work

Your children may watch you withdraw money from the ATM or using a credit card to pay for shopping, but they will find it hard to understand how does banking transaction actually works. Kids being kids, they may just think that money would freely be given to you when you go an ATM machine. Bring them to the bank and open a savings account where they can put deposit their savings into. Show them how it works and how online banking works as well. While savings account generate some interest, also teach them different saving strategies that helps them generate interest. Your child will then learn to appreciate saving money when they watch their savings grow.

- House chores

Letting your child earn some money through doing house chores is one of the simplest ways to teach them about earning money. However, some parents have raised concerns that this method may backfire whereby children are only willing to help out at home only if they’re paid for it. Therefore, one suggestion would be instead of paying them for each completed chores, you can instead give them a weekly allowance with condition to help out with the chores.

For elder children, parents should encourage them to take up part-time jobs during the school holidays for them to get a taste of the working world. You don’t love them any lesser by doing so, and instead, you’re training them to be more independent, mature and take charge of their own finances at an early age.

- Money-related games

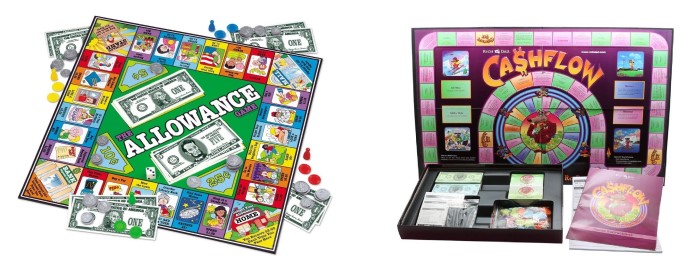

Another great way to let your kids learn money skills in a fun way is by playing games! There are many suitable money-related card and board games which is designed for different age groups of children and teens. Some games teaches on savings & spending while some teaches on managing cash flow and investments. It is surely worth investing in these games to play together with your kids at home. Some of the money-related games you can choose from are Monopoly, Payday, the Game of Life, the Allowance Game, Act your Wage, Thrive Time for Teens and Cashflow 101.

- Send your child for financial literacy class

There are a few enrichment centres and schools that offer financial literacy classes that you can send your child to. As they have a structured syllabus for your child to follow, this builds a stronger foundation for your child as they will learn money skills step-by-step. For example, Dwi Emas International School takes a distinctive viewpoint on financial literacy and adopts an entrepreneurial programme to their curriculum. Edu Talent, a one-stop talent and fitness enrichment centre offers Financial Literacy in their programme as well.

Ultimately, it is crucial to start teaching good money habits in our kids at a young age! You will be surprised how mature and independent your child can be when they grow up! Here’s a link to check out the Top 7 Enrichment & Sports Centres for Your Child in KL & Selangor that you send your children to.